.png)

.png)

HFCU Investment & Retirement Services

It's Time to Clean House with Your Finances

Most of us are private with our homes, family and finances. We actually clean the house the first time before we interview a housekeeper! The same thought holds true with our finances; we will clean them up, acquire money and then seek out a financial professional.

Life is busy. Let us help you to stay on top and be successful!

At HFCU Investment & Retirement Services, we are available to help you make sound financial choices. It is not an intimidating experience — it is a helpful one. To make you more comfortable seeing us, let us explain how we work for you.

We Collect Information

Our needs-based approach means learning more about your financial needs, situation and goals. We gather information through face-to-face meetings, phone conversations and written communications with you.

Analyze and Make Recommendations

We study your basic input carefully, then prepare recommendations based on your financial foundation and the goals you are trying to reach.

Activate the Program with You

Then working closely with you, we activate your financial management program. Any decisions you make and any actions you take are entirely up to you.

Conduct Periodic Reviews

People, personal circumstances and the economy change. The most important part of your financial process is periodic reviews. We monitor your financial management program with you, keeping it on course to pursue your financial needs and goals.

We can assist you with:

- Money Management

- Insurance Planning

- 401(k) Planning

- Retirement Planning

- Estate Planning*

- Investment Planning

- Business Planning

- Education Planning

Initial consultations are offered at no cost or obligation to members of Hershey FCU.

Call 717-533-9174 ext. 410 today to start planning for tomorrow.

Tristan Hill

Financial Advisor

(717) 533-9174 ext. 410

Check the background of this investment professional on FINRA’s BrokerCheck (Opens in a new Window).

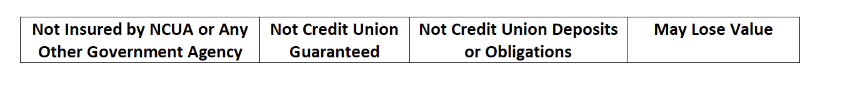

Securities and advisory services are offered through LPL Financial (LPL), a registered investment advisor and broker-dealer (member FINRA (Opens in a new Window)/SIPC (Opens in a new Window)). Insurance products are offered through LPL or its licensed affiliates. Hershey Federal Credit Union and HFCU Investment & Retirement Services are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using HFCU Investment & Retirement Services, and may also be employees of Hershey Federal Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Hershey Federal Credit Union or HFCU Investment & Retirement Services. Securities and insurance offered through LPL or its affiliates are:

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

The LPL Financial registered representative(s) associated with this website may discuss and/or transact business only with residents of the states in which they are properly registered or licensed. No offers may be made or accepted from any resident of any other state.

Hershey Federal Credit Union provides referrals to financial professionals of LPL Financial LLC (“LPL”) pursuant to an agreement that allows LPL to pay Hershey Federal Credit Union for these referrals. This creates an incentive for Hershey Federal Credit Union to make these referrals, resulting in a conflict of interest. Hershey Federal Credit Union is not a current client of LPL for advisory services. Please visit https://www.lpl.com/disclosures/is-lpl-relationship-disclosure.html for more detailed information.